The cryptocurrency lender celsius announced early Monday to its community that it is pausing its swap, transfer and withdrawal. The timeline of this pause is not mentioned anywhere in their announcement.

“We have a single goal: to maintain and defend our assets to meet our responsibilities to our community.”Our goal is to normalise liquidity as soon as possible and reinstate withdrawals and transfers.” Much work is ahead as we explore alternative solutions that may delay withdrawal reinstatement. We need your help and patience while we rebuild.”

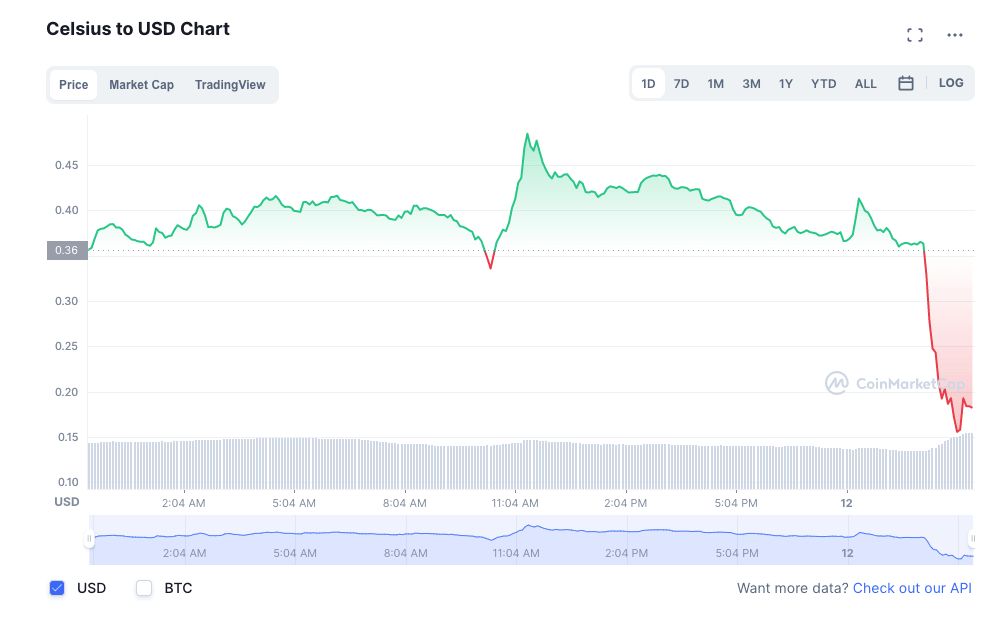

Cryptocurrency lender celsius falls 70% in one hour.

After the announcement of pausing the withdrawals, According to CoinMarketCap, the company’s CEL token dropped 70% in one hour from a previous high of $0.49 earlier on Sunday to $0.15.

On Twitter, crypto investors drew parallels between the latest Terra collapse and the famed crypto Ponzi scam Bitconnect.

Is cryptocurrency lender celsius hiding something?

Alex Mashinsky, the CEO and Co-founder of celsius, requested it’s the community to ignore the people who are objecting to the pause as they have a bigger plan.

He mentioned in a youtube Livestream on July 17 2022, “Don’t listen to these people before looking at the facts. A few minutes later, he reassured the audience of “Celsians,” as the platform’s users are known, that the corporation is using their cryptocurrency deposits carefully.

Celsius network works like a bank, It borrows from one client and lends it to the other, and the difference is the profit earned by the company. Unline banks celsius borrow only in cryptocurrency and lends in cryptocurrency. As of June, the firm claimed to have received more than $1 billion in cryptocurrency deposits.

As an illustration of its strict lending criteria, Mashinsky mentioned that cryptocurrency lender celsius rigidly mandates collateral when giving out loans to any other company.

“When one is using a platform, all you care about is who is the borrower, right?” Mashinksy explained. “Does the lender make uncollateralised loans?” Celsius does not make unsecured loans. Celsius will not do so since it would be hazardous on your side.”

But on the other hand, this statement becomes untrue when a celsius representative mentions.

“Out of tens of thousands of loans provided since 2018, Celsius’ total uncollateralised Loans are less than a tenth of one per cent.” On July 13, Golovina emailed CoinDesk, pointing to the number of loans but not the amount of money.

Golovina did not respond when asked about the monetary amount of the uncollateralised loans and Mashinsky’s denial of their presence on the AMA.

Is cryptocurrency lender celsius Network the next big thing?

Celsius has just raised $20 million from the crowdfunding platform BnkTotheFuture, including $10 million from stable coin issuer tether. Due to this, celsius is a significant player in the budding crypto industry.

The lending activity has risen over the past year as the investors seek high investment returns. Others attempted to raise funds without selling their coins, while market makers borrowed to meet orders swiftly.

The effect has the potential to boost crypto asset liquidity and price discovery.

But like any other lending risk, cryptocurrency lending also comes with its risk. And cryptocurrency lender celsius may be taking on more risk than its depositors are expecting it to take.

Regardless of how much unsecured lending Celsius performs, it appears that the majority of its loans are collateralised. To borrow $1,000 at a rate of 0.7 per cent, a trader must commit around 0.43 BTC of collateral to Celsius, and if the value of that collateral declines, the loan is vulnerable to margin calls.

Celsius has many times invested deposits into enduring swaps. People acquainted with Celsius’ operations described them as futures-like contracts with no expiration date.

Perpetual swaps work to settle the index periodically, allowing its traders to secure positions without rolling them over. According to a source, celsius also follows this activity to maintain its position.

However, celsius has denied any kind of perpetual swaps.

“Our business is to lend bitcoin to institutions,” Mashinsky said to CoinDesk via email.

Should the depositors be concerned about rehypothecation?

Rehypothecation is a technique in which banks and brokers utilise assets placed as security by their clients for their interests.

Mashinsky found celsius in 2018. Like many other cryptocurrencies, he wanted his service to be a way to democratise finance. In an interview, he mentioned the goal is to provide “fair interest income for 7 billion people”.

Cryptocurrency lender celsius lends out portions of the collateral borrower’s hand over to depositors, people with knowledge of the matter said. The practice, known as rehypothecation, is similar to how subprime loans were repackaged and sold as mortgage-backed securities before the 2008 financial crisis. This is why crypto miners don’t take out loans from the firm – they don’t want to end up unable to access their crypto.